Florida Retirement Planning

Core Financial Group

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

Core Financial Group is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

06

Six Fundamental Financial Planning Considerations

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

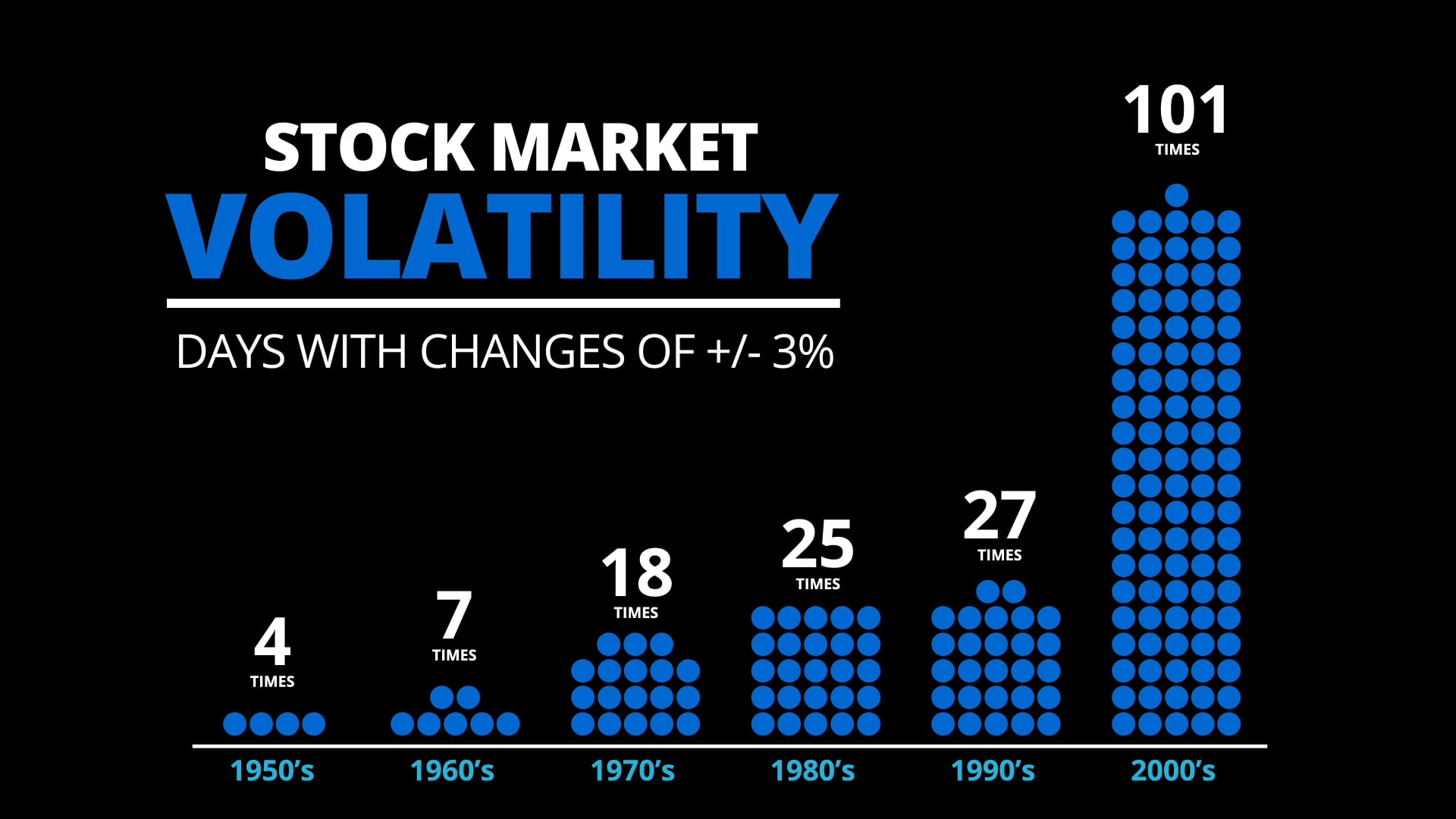

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

A Balanced Approach

Our Services

DROP and FRS Specialists

We understand that those in the FRS system face unique issues when planning for retirement. By specializing in this area, we’ve amassed a wealth of knowledge about how the system works and how to maximize your benefits.

Retirement Income Planning

Design an income plan that delivers dependable income and financial security throughout your retirement.

Social Security Optimization

Understand the benefits you are entitled to and how to maximize Social Security income in retirement.

Life Insurance and Long-Term Care

Ease the financial and emotional toll of unexpected life events and long-term care needs with early planning so you can retire with peace of mind.

At Our Core

Meet The Team

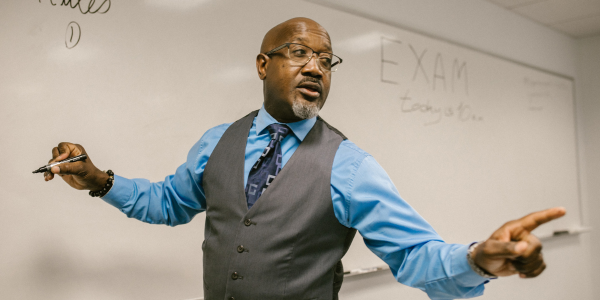

Dagean Larsen

Co-Founder

Dagean Larsen is an investment advisor representative focused on helping each of his clients retire with dignity and live out their dreams in retirement through well thought out strategies for their retirement income.

In 2006 he married his wife, Sharah and they live in Longwood, Florida with their two sons, Elijah and Deagan. Dagean began his career in 2009 after the death of his father, although being the second youngest of seven children he was named trustee of all his father’s account. At the time, his mother was 62 years and had no source of income besides Social Security. She was, however, to receive a life insurance check that needed to be turned into stream of income for the rest of her life. Dagean spent an entire month meeting with many financial advisors and after much planning was able to accomplish his objective and secure a comfortable income for his widowed mother. He has turned his personal experience with his mother into his career and continues to take a personal interest in each individual to give them confidence and pursue their dreams.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in January–March 2026

- There are no events scheduled during these dates.

Our Downloads

Social Security Guide

What To Know And How To Maximize

Social Security planning is one of the most important elements in any retirement plan, but getting the most from your Social Security benefit can also feel complex and frustrating. In our guide, “Maximizing Social Security in Today’s World,” you’ll uncover practical tips and easy-to-understand steps to get the most out of your Social Security benefits.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.